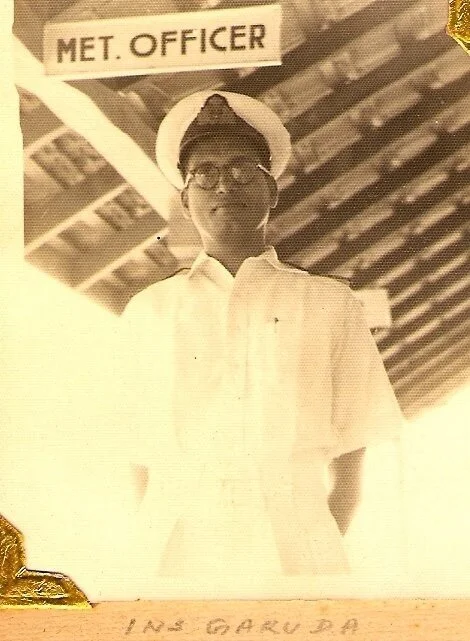

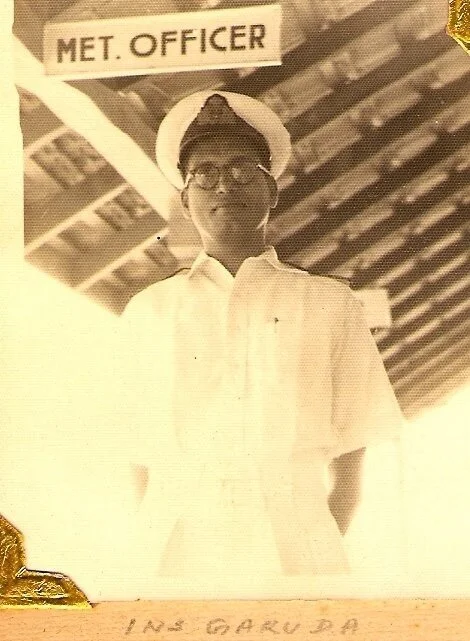

My grandfather was the first meteorologist in the Indian Navy. He spent the first part of his career as a Physics lecturer (Presidency College, Madras). When the British left in 1947, they trained up Indians to take their places on the ships, and scientifically trained Indians (rare at that time, how things have changed!) were needed. In an unusual career move as a 40-something, he left academia and set sail on the high seas. Meteorologists have a word for predicting the weather a few hours out, 2-3 hours at most. It is forecasting based on the “now” conditions = Nowcasting. Finance researchers have borrowed this term, and there’s even an excellent macroeconomic data firm called Nowcasting created out of London Business School.

Nowcasting is what your inbox is being flooded with from investment bankers and wealth managers. Try to ignore them. Everyone has their model and assumptions. Goldman Sachs first modeled a 20% dip in US GDP for Q2, then revised it to 35% down. I’ve seen other equally sophisticated models predict 50%. It’s all Nowcasting, slightly useful directionally, but imprecise as to numbers. Unless you’re an active market maker or finance researcher, it’s not very emotionally healthy.

We are in the middle of a financial hurricane. The thing about hurricanes is that they do end. You have to decide where you will end up when the storm ends. If you’re an aircraft carrier - you’ve been around a long time and have lots of set protocols in place and robust teams, you’re going to get seasick, but you’ll survive. Stop thinking you’re the Titanic. If you’re a startup in a dinghy (like me), you’re better get ready to reinvent yourself.

There are a lot of World War analogies floating around. The hard part of a war is not knowing which side is going to win. There were many times in the 1940s that either the Allies or the Axis could have triumphed. This is a war of homo-sapiens versus COVID-19. We know who wins in the end - US.

Stress test yourself. Make a simple budget for the next year and see when you run out of cash. A new academic study of 14k+ listed company earnings over 26 countries. A 25% drop in sales suggests 6% of companies run out of cash in 6 months. A 75% drop in sales suggests about a third would run out of cash in 6 months. If you’ve been careful you aren’t the Titanic… but you have to work the numbers.

Currently, we are killing businesses to save lives. When the peak passes, I wonder how much cooperation people will give authorities about continuing to destroy their businesses. The very flattening of the curve will yield a lower death number, which weakens the government’s case for a continued lockdown.

It’s hard not to obsess about both the market and epidemiological Nowcasting. I keep an eye on both over different models, and here’s what I think.

I feel the chance of a quick recovery is gone. At the same time, this is not Russia in 1917, Cuba taken over by Castro type scenario. Americans will want to continue to be entrepreneurial and capitalistic. I can’t see Indians giving up their newly won perks of going out to restaurants, buying phones, and educating their children abroad. Sure there will be a significant dip, but for those of us with resources and seed corn, we will prevail if we don’t panic. Many of the quants I respect have now put out their long term analysis. No one is predicting an apocalypse or systemic failure. Extremely challenging for sure and lethal for some, but the cogs of capitalism are paused, not broken.

There is a loss in revenue, but is it temporary or is it permanent? Maybe you’ll have to appeal to different demographics, jazz up your marketing, but if you’re an aircraft carrier, the hurricane will set you on a different seasick course for now. Still, the mechanisms to adapt will show themselves, you just can’t see them now. If you’re in a dinghy - an independent restaurant owner or consultant, it is all about personal survival until you can row back into the water with an acceptance that this might need to be in a new boat.

What can I help you with? What would you like to see me write about?

Thanks,

Mallika